Less Money Invested Into Crypto Funds Due to Stagnated Market

- March 12, 2021

- Jennifer Moore

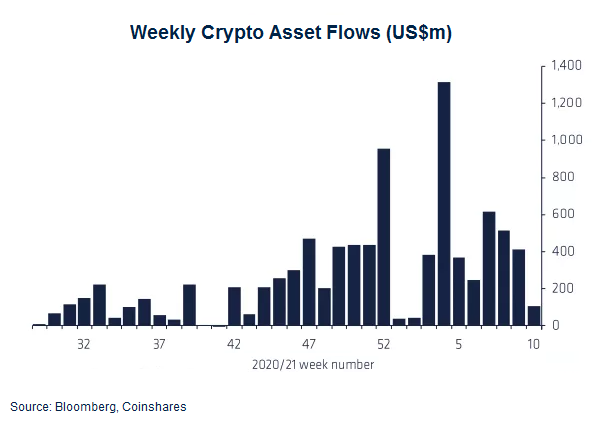

The inflows to cryptocurrency asset funds dropped last week. It fell the lowest when you compare to the earlier period this year similar to Bitcoin, ether, and additional cryptocurrencies. Moreover, other cryptocurrencies happened to retreat from all-time high-cost levels.

Expert’s Analysis

According to experts, here is a brief analysis of the price drop levels.

- The products focus on Bitcoin accounted for approximately 90% of the cryptocurrency fund inflows last week. Among them, there are minor inflows to Polkadot and Ethereum investment products, according to experts.

- The drop of inflows went 108 million dollars throughout the week that ended on 5th March. It is the lowest from January and down from approximately 400 million dollars the earlier week.

- Presently, investment products represent 7% of Bitcoin trading volumes this year. This is in comparison with 4% in the last year.

- Despite two weeks’ absence of activity, the net flow this quarter so far happens to be only two-thirds of the way throughout the three-month time period. It already happened to match the entire for 2020.

- A physically-backed ethereum ETP was launched last week on a Swiss exchange under the name of ETHE.

- Digital assets that were under management concerning exchange-traded per product were seen to double to 43.9 billion dollars in February, according to experts. Among these, the maximum assets happen to be residing in Grayscale’s Bitcoin Trust.

Also Read: FAQs on Bitcoin: Things to Consider Before an Investment

Final Words

According to data, approximately 97% of inflows went to Bitcoin. This year, so far, highlighted that the Bitcoin volumes have remained considerably higher. Moreover, according to reports and insights on blockchain data, the net unrealized profit and loss of Bitcoin were about to get near to exceeding the belief range, thereby moving into the euphoria range.

Categories

- AI (6)

- Altcoins (10)

- Banking (10)

- Bitcoin (132)

- Bitcoin ETF (11)

- Bitcoin Price (30)

- Blockchain (47)

- Brokering World Hunger Away (16)

- Business (7)

- CBDC (11)

- COVID-19 (3)

- Crypto ATMs (1)

- Crypto Banking (15)

- Crypto Bill (1)

- Crypto broker platform (26)

- Crypto Investment (3)

- Crypto Markets (3)

- Crypto Payment (26)

- Crypto Prices (1)

- Crypto Trading (88)

- Cryptocurrency (365)

- Cryptocurrency Exchange (95)

- Data Visualization (2)

- Decentralized Finance (7)

- DeFi Payment (9)

- DEX (3)

- Digital Currency (22)

- Ethereum (2)

- FAQ (6)

- Finance (24)

- Financial Equality (4)

- Financial Freedom (8)

- Forex (24)

- ICO (1)

- Investment (11)

- Mining (3)

- News (64)

- NFTs (2)

- P2P (1)

- PayBitoPro (606)

- PayBitoPro Coin Listing (6)

- PayBitoPro Exchange (2)

- Post COVID Digital Transformation (1)

- Press Release (130)

- Privacy & Security (3)

- Real Estate (1)

- Stablecoin (4)

- Technology (14)

- Uncategorized (2)

- US Presidential Election (2)

- Utility Coin (1)

- Web3 Wallets (1)

- White Label Crypto Broker Solution (1)

- White Label Crypto Exchange (6)