US COMPETES Act harms global crypto trading

- January 31, 2022

- Jennifer Moore

With bated breath, the global crypto community is awaiting the final outcome of the US federal government’s latest policy meeting regarding digital assets. It is being assumed that the administration under Joe Biden may draft an executive order regarding cryptocurrencies with multiple federal agencies assessing the possible risks and impact.

The news of a possible upcoming crypto bill appeared a day after the United States Federal Reserve Board(FRB) presented a paper highlighting the possible merits and demerits of implementing a Central Bank Digital Currency seeking public opinion till May 30, 2022. Countries with robust economies are rushing towards CBDC development to get an edge over other nationals and exclusive power centralization,

America COMPETES Act 2022

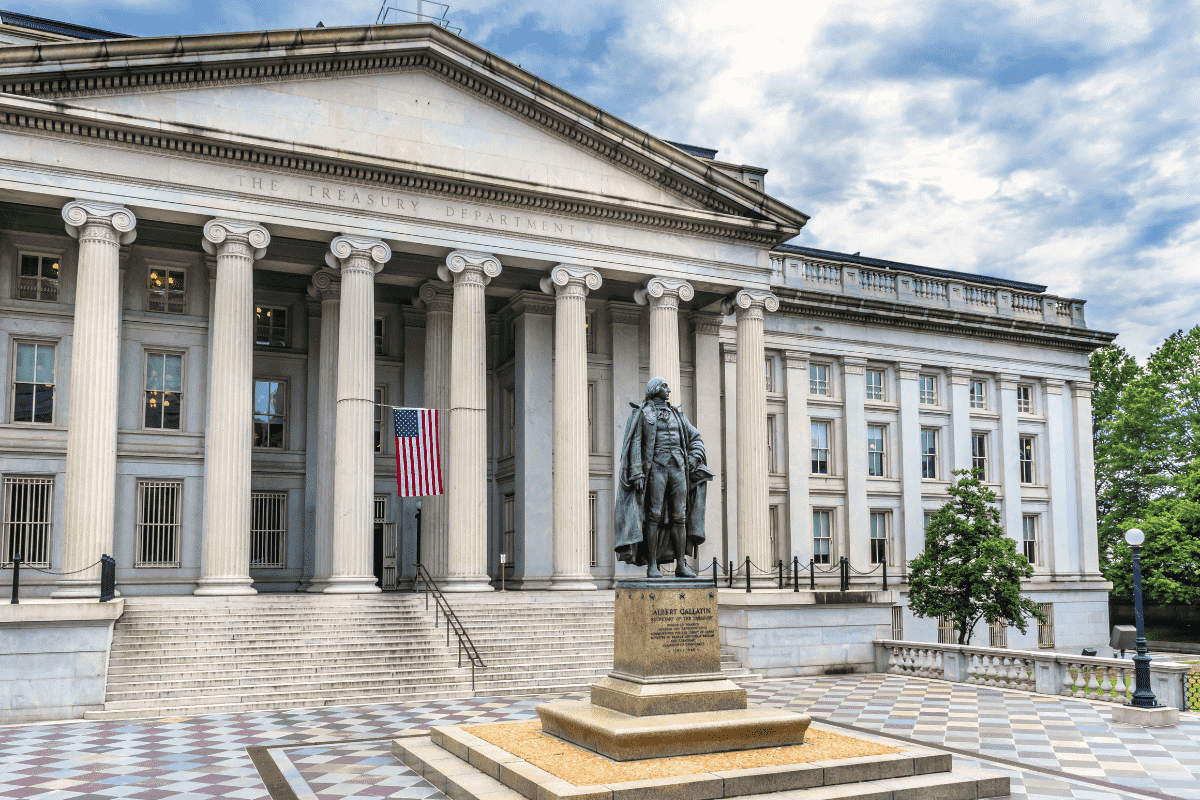

The bill recently released to the members of the House contains a provision seen as disturbing to members of the global crypto community. Proposed by Rep. Jim Himes, the America COMPETES Act would empower the US Secretary of Treasury with enormous and unhinged power. Once enacted, the Secretary can forbid exchanges or financial institutions from conducting crypto transactions.

An acronym for Creating Opportunities for Manufacturing, Pre-Eminence in Technology and Economic Strength, the America COMPETES Act of 2022 may create startup opportunities, but granting authority to bypass due crypto-transactional checks and balances would spell disastrous for cryptocurrencies. The ability to surveil financial institutions will come at the cost of disrupting the global crypto trade- one of the most promising markets worldwide.

US’s Political Perspective on Crypto

The federal government agencies have been routinely analyzing cryptocurrencies and their possible impact, designing policies as counteractive measures. The analysis, over the course of several years, was done independently in a fragmented fashion. There was no confirmatory response from their end, adding to the woes of the growing crypto industry.

Regulatory government bodies like the OCC, SEC and CFTC did issue/release multiple letters of guidance for investors, informal statements. Over the years, they also encouraged public cooperation in rule-making and compliance law in regards to crypto. However, the efforts have been largely uncoordinated.

Also Read: SEC Nods to First US Futures-based Bitcoin ETF Launch

Impact on Crypto Community

The Fed has a tough task at hand- it has to delicately balance the unpredictable line of curbing inflation without setting off already apprehensive markets. The challenge is not completely under their control.

The impact, however, will likely be short-term. Investments may reduce if the Fed Reserve announces credit market tightening. With an increased difficulty in fundraising, crypto-startup will have to bear the brunt. However, since blockchain as a technology will stay for a long time, the recovery will not take long. Both traders and businesses will gain attractive investment opportunities in the medium to long term.

Final Words

When asked about the possible impact, finance experts from major organizations are preferring to stay neutral. The new law by the US central bankers may very well create an adverse situation triggering a domino effect and making ripples worldwide. Coincidentally, this is the exact financial system blueprint that cryptos can improve.

Categories

- AI (9)

- Altcoins (10)

- Banking (10)

- Bitcoin (133)

- Bitcoin ETF (11)

- Bitcoin Price (30)

- Blockchain (49)

- Brokering World Hunger Away (16)

- Business (9)

- CBDC (11)

- COVID-19 (3)

- Crypto ATMs (1)

- Crypto Banking (17)

- Crypto Bill (1)

- Crypto business owner platform (31)

- Crypto Investment (3)

- Crypto Markets (5)

- Crypto Payment (29)

- Crypto Prices (1)

- Crypto Trading (92)

- Cryptocurrency (401)

- Cryptocurrency Exchange (108)

- Data Visualization (2)

- Decentralized Finance (7)

- DeFi Payment (9)

- DEX (3)

- Digital Currency (22)

- Ethereum (2)

- FAQ (6)

- Finance (24)

- Financial Equality (4)

- Financial Freedom (8)

- Forex (24)

- ICO (2)

- Investment (11)

- Mining (3)

- News (66)

- NFTs (2)

- P2P (1)

- PayBitoPro (692)

- PayBitoPro Coin Listing (6)

- PayBitoPro Exchange (2)

- Post COVID Digital Transformation (1)

- Press Release (130)

- Privacy & Security (3)

- Real Estate (1)

- Stablecoin (4)

- Technology (14)

- Uncategorized (3)

- US Presidential Election (2)

- Utility Coin (1)

- Web3 business (3)

- Web3 Wallets (2)

- White Label Crypto Exchange (6)

Recent Posts

- Why Blockchain Education Is Key for Web3 Adoption

- Web3 Business Marketing: Building Community and Brand for Your Crypto Venture

- Why Blockchain Awareness Is Critical Before You Dive Into Web3

- Why Market Research Is the Foundation of Every Successful Web3 Business

- Start A Web3 Business: A Step-by-Step Web3 Startup Guide for Entrepreneurs