The Price of Bitcoin Reaches Beyond $20,000 for the First Time

- December 17, 2020

- Jennifer Moore

Bitcoin is said to have clawed back each of its losses from the greatest rout since March. Therefore, indicating a resiliency within the cryptocurrency rally that has outperformed the most significant asset classes in 2020.

Bitcoin Price Volatility

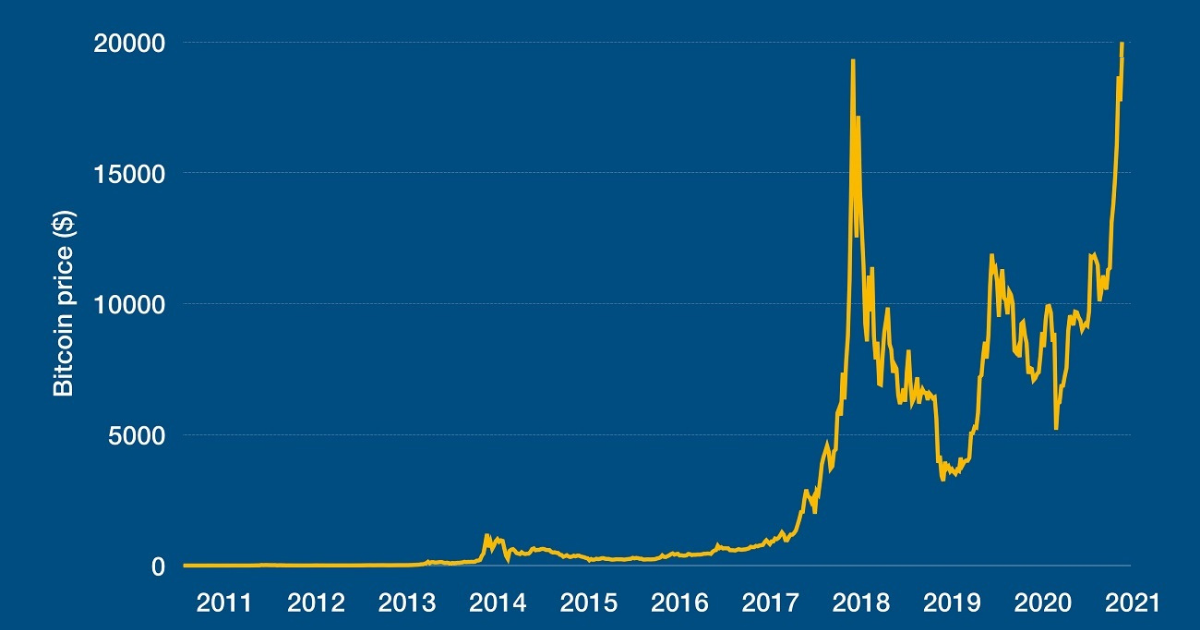

After touching a record high of $20,000 in late November, Bitcoin stalled and also went below $17,000 stoking fears. Moreover, it is likely to be a repeat of the asset’s collapse in 2018. As per the reports, the long-term Bitcoin holders have been selling their virtual currency after the amount reached a record peak. However, it noted that this happened to be an overall long-term bullish signal as compared to the earlier price trends.

Bitcoin Rallies Above $20000 After Pandemic

Bitcoin, being the most traded digital asset, added approximately 5% more to $19109 and rose over the weekend. It topped the peak of Bitcoin’s closing level. The price is said to have smashed through $20,000. It happened for the first time on Wednesday and counted as its highest score ever. The rate of cryptocurrency leaped from 4.5% to move as high as $24440. Additionally, it comes with the potential for purported resistance to expectations and inflation. Moreover, it will turn out to be the mainstream payment option.

The crypto has hit an all-time peak amount of $20800 and lasted up to 6.4 % at $20675. Gaining higher than 170% in 2020, it was buoyed by the demand for bigger investors that attracted a possibility for quick gains. Smaller coins like XRP and Ethereum, open moving in tandem with Bitcoin. These are said to have respectively gained 5.4 % and 8.1 %.

The co-founders and partners of trading firms anticipated many of their clients to expect Bitcoin to surpass its all-time new high of $20,000. Thus, provided the latest updates from major institutional players openly endorsing Bitcoin. British fund managers approximately managed 27.3 billion dollars in assets during the end of November. They also made a bet on how the price of Bitcoin is presently around 745 million dollars.

Also Read: 5 Essential Bitcoin Factors to Look For as New Investors Purchase BTC in 2021

Impact of Bitcoin’s Rush

The massive flow of Bitcoin’s rush has witnessed the flow from East Asia to North America but by the hunger for Crypto among numerous US investors. Bitcoin’s rally has been acting as a possible safe haven for various investors, thereby coinciding many investors with spot gold’s drop in late periods. Family officers and hedge funds who, in the past, refused the blank nature of the cryptocurrency market. When it comes to strict oversight concerning the Crypto industry in the United States of America, it has helped soothe many of those problems and concerns.

Categories

- AI (6)

- Altcoins (10)

- Banking (10)

- Bitcoin (132)

- Bitcoin ETF (11)

- Bitcoin Price (30)

- Blockchain (47)

- Brokering World Hunger Away (16)

- Business (7)

- CBDC (11)

- COVID-19 (3)

- Crypto ATMs (1)

- Crypto Banking (15)

- Crypto Bill (1)

- Crypto broker platform (26)

- Crypto Investment (3)

- Crypto Markets (3)

- Crypto Payment (26)

- Crypto Prices (1)

- Crypto Trading (88)

- Cryptocurrency (365)

- Cryptocurrency Exchange (95)

- Data Visualization (2)

- Decentralized Finance (7)

- DeFi Payment (9)

- DEX (3)

- Digital Currency (22)

- Ethereum (2)

- FAQ (6)

- Finance (24)

- Financial Equality (4)

- Financial Freedom (8)

- Forex (24)

- ICO (1)

- Investment (11)

- Mining (3)

- News (64)

- NFTs (2)

- P2P (1)

- PayBitoPro (606)

- PayBitoPro Coin Listing (6)

- PayBitoPro Exchange (2)

- Post COVID Digital Transformation (1)

- Press Release (130)

- Privacy & Security (3)

- Real Estate (1)

- Stablecoin (4)

- Technology (14)

- Uncategorized (2)

- US Presidential Election (2)

- Utility Coin (1)

- Web3 Wallets (1)

- White Label Crypto Broker Solution (1)

- White Label Crypto Exchange (6)