Worldwide Crypto Adoption Index 2022

- September 20, 2022

- Jennifer Moore

Cryptocurrencies have come a long way since their inception in 2009. The unknown digital asset is now globally famous. Its global adoption as a legal currency in several countries. Cryptocurrencies aimed to develop a secure and anonymous method for conducting peer-to-peer transactions. In 2021, November, Bitcoin the oldest cryptocurrency reached its highest peak with a valuation of $65,000. However, due to the volatility of the market, the prices faced a huge drop in 2022. Surprisingly, it didn’t stop people from using cryptocurrencies around the world.

A Survey By Chainanalysis

The total market capitalization of cryptocurrency stands at $1.76 trillion, with a daily reading volume of $93.4 billion. While many countries have banned cryptocurrencies, several others have adopted digital currency for trading and receiving payments. Currently, three out of four people invest in cryptocurrencies in America. Every year Chainanalysis, a global tech research firm conducts a survey to prepare the global crypto adoption index. Here’s an excerpt of the index that is yet to be released.

Also Read: First Bitcoin Anniversary in El Salvador: Here’s How The Year Has Been

Grassroot Crypto Adoption: What is it?

Usually, calculating the raw transaction volume of the cryptocurrencies in a country provides the results of the overall crypto activity. However, Chainanalysis aimed for something different, and the index was prepared by looking into account in which country people were investing the majority of their economy in cryptocurrencies. Keeping that in check, the report was also prepared to focus on the non-professional investors to accept and buy cryptocurrencies. Here’s a short brief on how the method Chainanalysis used to prepare the index.

Also Read: Does The Ethereum Merge Mark a Big Bang in The Crypto Universe?

Method Used By Chainanalysis

There are five sub-indexes that Chainanalysis follows based on the different use of cryptocurrencies for every country. The research was conducted keeping all the 146 countries in consideration, to collect enough data and rank countries accordingly. The firm aimed to calculate the overall subindexes, and rank the countries based on the five indexes. The volume of crypto transactions for the specific patterns and protocols, the web traffic data, VPN use, and many more, play a role in ranking the countries. Here are the five sub-indexes, that Chainanalysis considered while calculating them.

Purchasing Power Parity Per Capita

The sub-index aims to rank the countries by the overall cryptocurrency activity that is taking place in a centralized service, and then check the ranks in favor of countries based on the average person’s wealth and the value of money within the country.

On-Chain Retail Value Provided by Centralized Services

The metric aims to measure the activities of professional and non-professional crypto users at centralized services based on the volume of cryptocurrencies transacted in comparison to the average person’s wealth. The calculation by measuring the crypto movement in retail transactions, which amounts to under $10,000 worth of crypto.

P2P exchange trade volume

One of the significant parts of all cryptocurrencies is made up of P2P trade volume in the growing markets. For the sub-index, the countries are ranked by their peer-to-peer trade volume and favor the countries with lower PPP per capital and few internet users. The goal is to highlight the countries where residents are investing a large share of their total wealth into P2P crypto transactions.

The On-Chain Crypto Value Obtained from DeFi protocols

Decentralized Finance is the fastest growing sector of a cryptocurrency over the last two decades. In the case of CEX vs. DEX, decentralized crypto strategies that largely use Ether as an opponent to Bitcoin, are now under centralized services in the transaction volume in on-chains. With the importance of DeFi to innovation, Chainanalysis adopted the index to focus on the countries where the users focus disproportionately high share of economic activity in DeFi protocols. For the particular sub-index, Chainanalysis ranks countries by the transaction volume of DeFi, favoring countries with low PPP per capita.

DeFi Protocol Provided On-Chain Retail Values

To incorporate non-professional crypto user activities in the index, the same is necessary for the DeFi protocols. Therefore, the sub-index ranks every country by DeFi transaction volume for retail-sized transfers, measured to rank countries with low PPP per capita.

Chainanalysis Made Changes to its Methods for 2022

The major change to the index methodology in 2022 was by adding two more sub-indexes on the transaction volume of Decentralized Finance. The improvement of two other indexes that include transaction volumes associated with centralized services. The two were introduced for two reasons. Firstly, to focus on the countries leading in DeFi and giving importance to the entire crypto ecosystem. And secondly, Chainanalysis wanted to address the inflation of transaction volume issues steered by DeFi.

Centralized services internally track the transaction volumes and no one can access them. However, for DeFi protocols, the scenario is different as these are non-custodial and route crypto between private wallets, therefore all transactions are visible on-chain. This means that if you are using on-chain data, the transaction volumes of DeFi protocols receive a trauma that volumes associated with central services do not obtain.

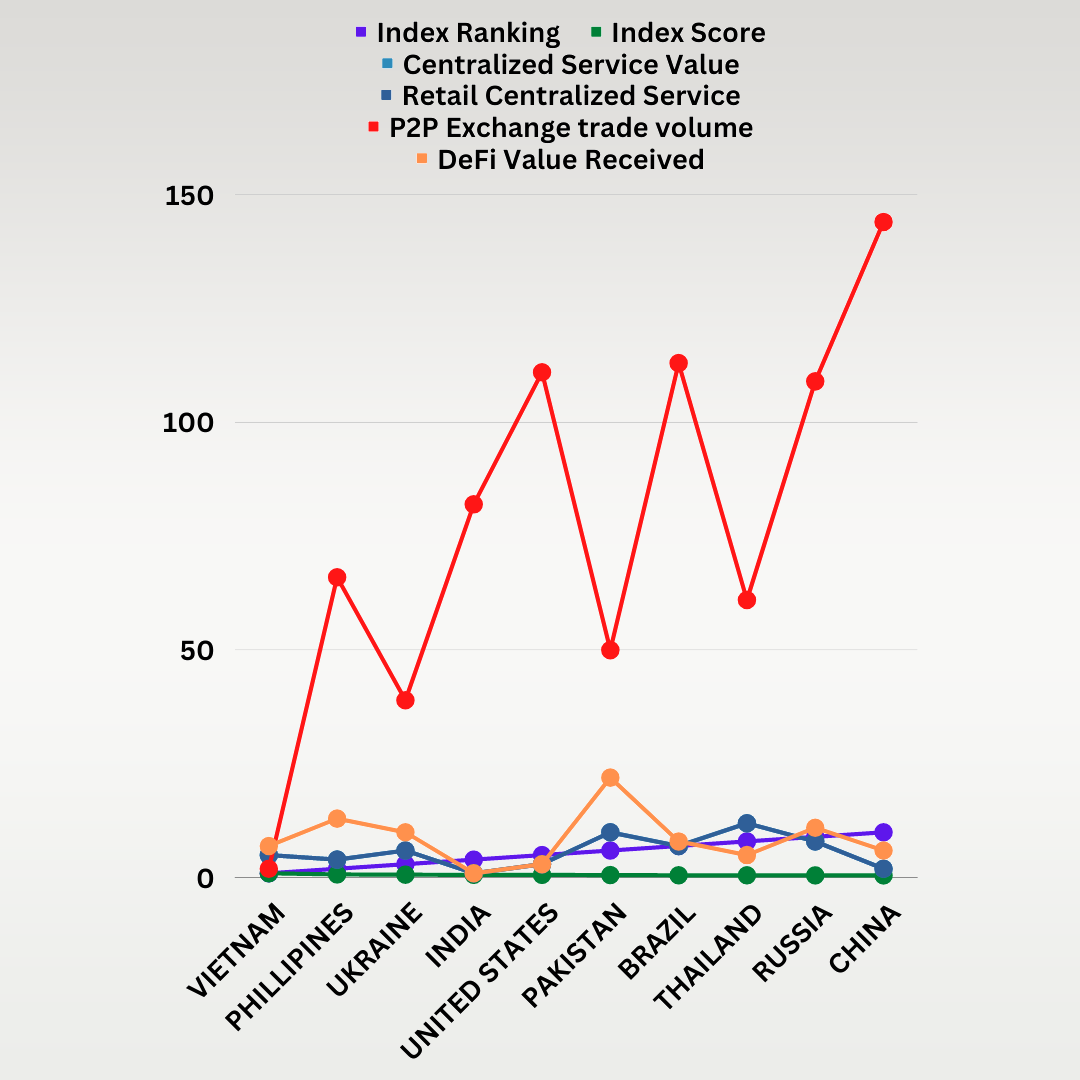

Top 10 Global Crypto Adoption Index 2022

Bottomline of the Crypto Adoption Index

Here are some of the important takeaways of the global crypto adoption research by Chainanalysis.

- Chainanalysis data shows that worldwide adoption has been off in the last head after consistently growing since 2019. The chart below shows the index of the paper after a worldwide summation of all the country’s index scores quarterly, from the second quarter of 2019 till today.

The all-time high of crypto adoption worldwide reached the highest point in the third quarter of 2021. However, since then the adoption has moved and fell drastically in the third quarter that is when the crypto prices dropped. The prices did rebound in the fourth quarter and reached their all-time highs. However, in the past two quarters, it has dripped and at present, the industry is in the bearish aspect. However, it is crucial to note that worldwide adoption remains above the number before 2019.

- Another trend in 2021 is only growing stronger, that is the developing markets are leading the index. World Bank classifies countries into one of four parts based on overall economic development and income levels which are upper-middle income, high income, lower-middle income, and low income.

The middle two sectors which are the upper middle income, and the lower middle income dominate the index. Among the top 10 countries, Vietnam, the Philippines, Ukraine, India, and Pakistan are lower-middle-income countries. While Thailand, China, and Russia belong to the upper-middle-income countries. However, the United States is a high-income country ranking fifth in the index.

In Conclusion,

While there has been a slow growth rate post the crypto crash of 2022, the global adoption index suggests that the growth has been still better than the 2020 pre-bull market conditions. A large portion of the research shows that the users who invested in crypto during the high prices are still the same even during the bearish market phase. One of the major reasons could be the value the users get from investing in the developing sectors. Since cryptocurrencies provide tangible advantages for people residing in unstable situations, the dynamics are still the positives.

Categories

- AI (6)

- Altcoins (10)

- Banking (10)

- Bitcoin (132)

- Bitcoin ETF (11)

- Bitcoin Price (30)

- Blockchain (47)

- Brokering World Hunger Away (16)

- Business (7)

- CBDC (11)

- COVID-19 (3)

- Crypto ATMs (1)

- Crypto Banking (15)

- Crypto Bill (1)

- Crypto broker platform (26)

- Crypto Investment (3)

- Crypto Markets (3)

- Crypto Payment (26)

- Crypto Prices (1)

- Crypto Trading (88)

- Cryptocurrency (365)

- Cryptocurrency Exchange (95)

- Data Visualization (2)

- Decentralized Finance (7)

- DeFi Payment (9)

- DEX (3)

- Digital Currency (22)

- Ethereum (2)

- FAQ (6)

- Finance (24)

- Financial Equality (4)

- Financial Freedom (8)

- Forex (24)

- ICO (1)

- Investment (11)

- Mining (3)

- News (64)

- NFTs (2)

- P2P (1)

- PayBitoPro (606)

- PayBitoPro Coin Listing (6)

- PayBitoPro Exchange (2)

- Post COVID Digital Transformation (1)

- Press Release (130)

- Privacy & Security (3)

- Real Estate (1)

- Stablecoin (4)

- Technology (14)

- Uncategorized (2)

- US Presidential Election (2)

- Utility Coin (1)

- Web3 Wallets (1)

- White Label Crypto Broker Solution (1)

- White Label Crypto Exchange (6)